British semiconductor firm IQE has reported a revenue drop of almost 40% in its 2023 half-year results.

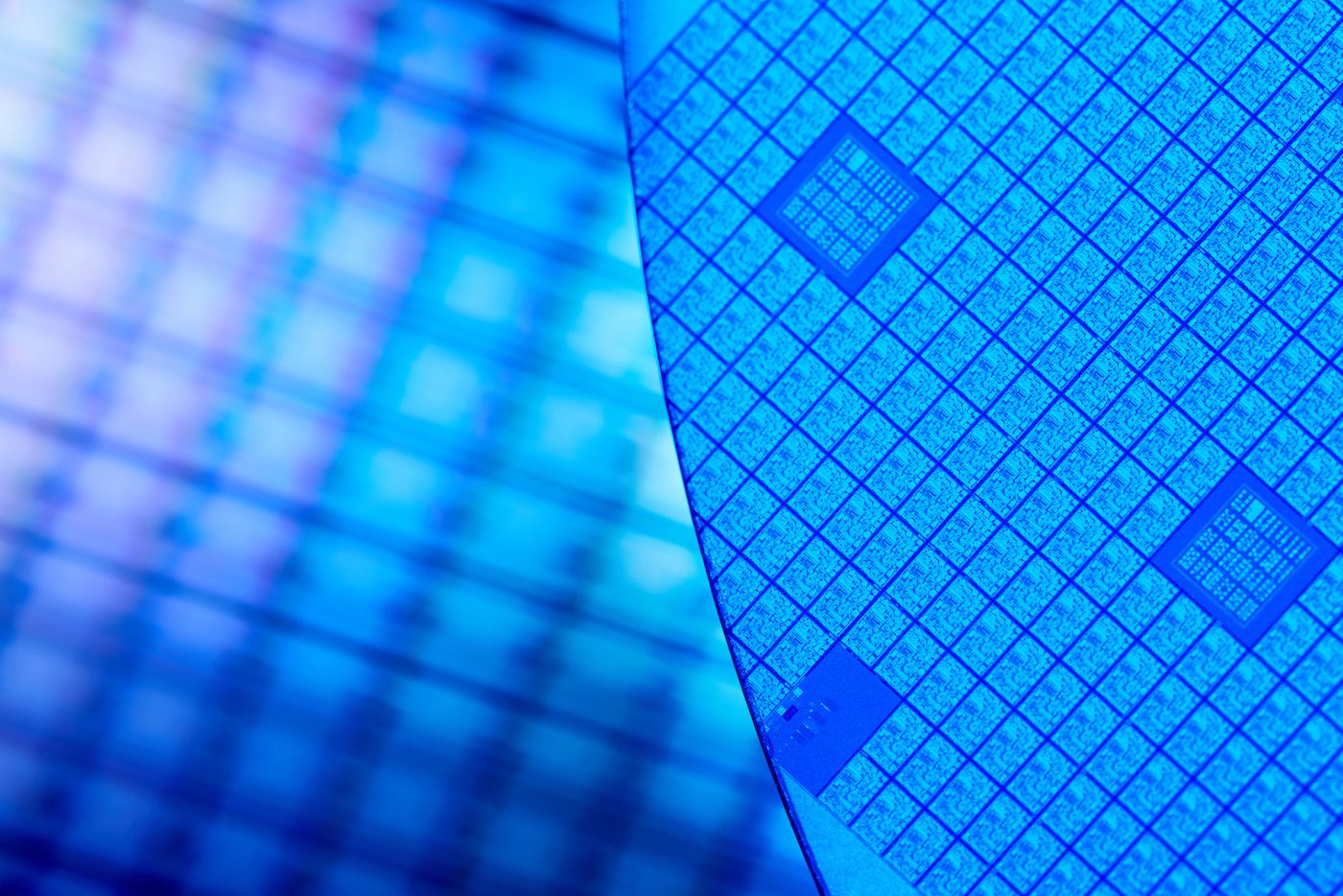

The Cardiff-based chip firm, which produces compound semiconductor wafers, saw revenues tumble from £86.2m in the first half of 2022 to £52m in the first half of this year.

Operating losses widened from £19.6m in the first half of 2023 compared to losses of £7.4m in the year-ago period.

In addition, IQE slashed its adjusted EBITDA from the £12.3m reported in H1 last year to a loss of £5.7m for the first half of this year.

The company said it was “adversely impacted by a reduction in sales and under-utilisation of capacity, particularly in the Wireless business”.

Americo Lemos, CEO of IQE, said: “We are accelerating our diversification strategy with new customer designs in GaN Power electronics and broadening our market penetration into the China wireless market.

“By expanding our customer base across the breadth of our product portfolio and ramping in strategic growth areas, we are focused on improving future business performance.”

Photonics made up the biggest share of IQE’s revenue for the first six months at £28m, followed by wireless at £22.4m. CMOS++, a type of transistor based on metal-oxide semiconductor field-effect transistor technology, accounted for £1.6m in revenue.

“IQE has delivered H1 revenue in line with our revised market guidance. In a challenging macro environment, we have taken decisive action to manage costs and deliver immediate efficiencies and longer-term margin benefits,” added Lemos.

Lemos is one of the experts brought in by the government for its Semiconductor Advisory Panel.

Shares in London-listed IQE were up 6% on Tuesday, but shares remain down by almost 67% since the start of the calendar year.