Register for Free

Bookmark your favorite posts, get daily updates, and enjoy an ad-reduced experience.

Already have an account? Log in

Bookmark your favorite posts, get daily updates, and enjoy an ad-reduced experience.

Already have an account? Log in

Ecosystem players

Abertay University

Dundee University

Edinburgh Napier University (including Bright Red Triangle)

Edinburgh University (including Edinburgh Business School, School of Informatics, Edinburgh Futures Institute)

Glasgow Caledonian University

Heriot-Watt University

James Hutton Institute

Queen Margaret University

Robert Gordon University

Scotland’s Rural College (SRUC)

St Andrews University

Strathclyde University (including Strathclyde Business School)

University of Aberdeen

University of Glasgow

University of Stirling

University of the Highlands and Islands

University of the West of Scotland

Skyscanner

FanDuel

Amazon

JP Morgan

NatWest

Microsoft

Amazon Web Services

Barclays

Morgan Stanley

RBS

IBM

CGI

Rockstar

UserTesting

Abrdn

KPMG

Company spotlights

Startups & scaleups to watch

The following startups and scaleups were named by tech stakeholders in Wales for their high-growth potential. Selected companies were each nominated by at least two different and independent stakeholders.

Click on company logos to reveal more information.

+

Amiqus is a compliance platform for legal, recruitment, public sector and financial services companies, covering digital identity verification, AML/KYC checks and pre-employment screening.

+

Workspace market Desana provides a platform to manage, pay for and use workspaces, with data analytics to inform workplace strategies.

+

Freelance and contract work platform Gigged.ai uses AI to help businesses find and hire the right person for project work.

+

IGS designs and builds industrial-scale vertical farms aiming to create the perfect growing environment, year-round.

+

Krucial’s solution combines satellite communications with IoT to help businesses achieve resilient connectivity and digitise operations.

+

Phlo is a digital pharmacy providing a ‘one-stop shop’ for medication needs, including medication and prescription management, advice from pharmacists and wellness services.

+

PlayerData’s wearable GPS tracker vest provides elite-level sports coaches with players’ performance insights which are quick to interpret for informed decision-making.

+

Rethink Carbon is a land management platform providing detailed analysis of land to enable owners to visualise and map future land use scenarios and evaluate the economic potential of their land.

+

Luggage storage company Unbaggaged manages the end-to-end process via its digital platform, including picking up luggage from users and dropping it back to them wherever they are in a city.

+

Valla is a legal platform for workers to self-represent in cases against employers, with the functionality to raise a complaint, send professional legal documents and navigate settlements or tribunals.

+

Edinburgh based climate tech spinout provides patented technology that captures carbon dioxide from industrial emissions.

+

Leap AI specialises in artificial intelligence-enabled robotics for the food production sector, with its PikPak solution designed to pack a wide variety of products, from small snacks to large cartons.

Graeme Williams, head of M&A – Scotland, KPMG in the UK

The Scottish tech sector has developed rapidly over the last five years in terms of the number of businesses scaling, and the inward investment they receive. Scotland is increasingly being viewed as a strong place for tech investment – supported by recent government and private investments.

The tech sector is growing one and a half times faster than the overall Scottish economy. It is predicted to be the second-fastest growing area of the economy over the next five years and now has close to 15,000 directly associated businesses in operation. This has resulted in the employment of over 400,000 people, turnover of over £220bn and top performing areas including net zero, clean tech, energy generation, life sciences and health tech.

Scotland’s tech sector has been growing steadily over the years, with Edinburgh often hailed as one of the largest hubs for tech and innovation startups in the UK after London.

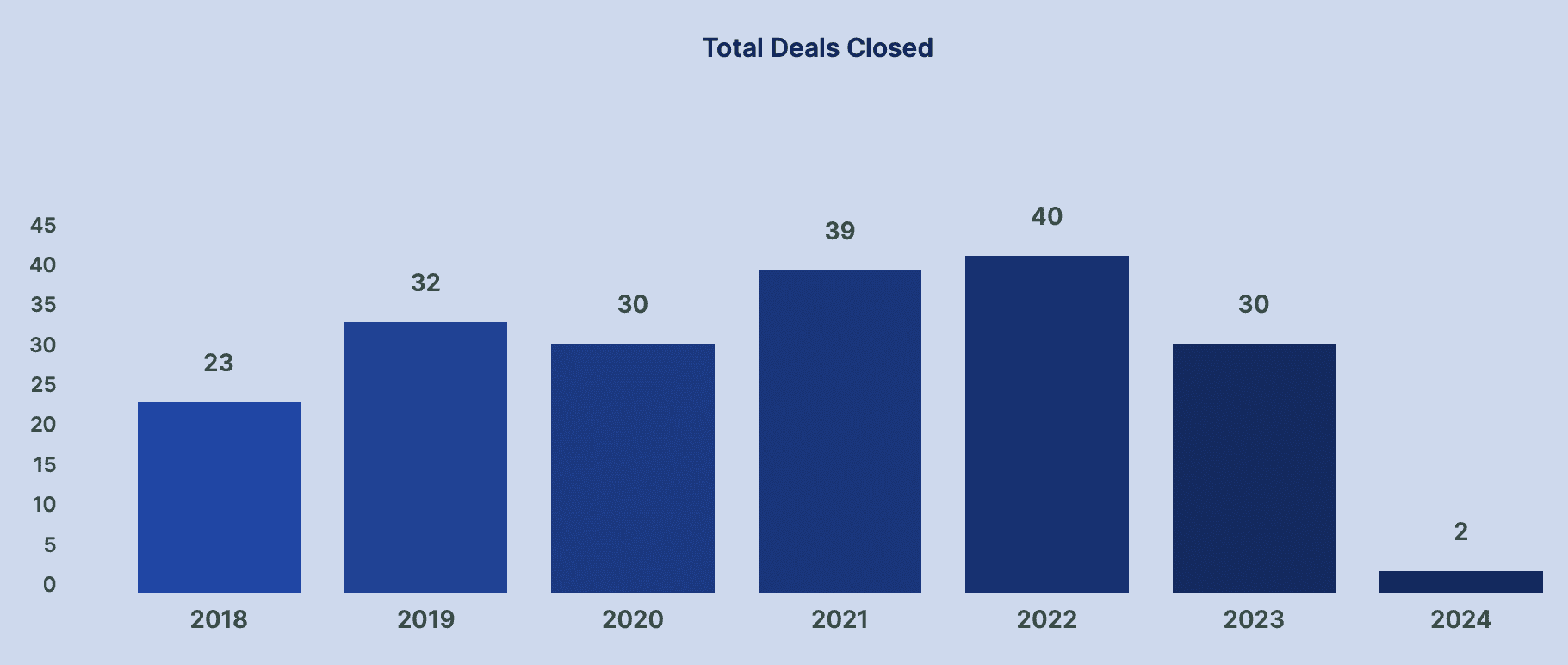

Since 2018, a total of 196 deals in IT have closed, with 2022 holding the record number of deals, followed closely by 2021. It is safe to assume that this was due to the Covid-19 pandemic, with workers and students being forced to work from home. Coupled with a fall in investments related to retail and hospitality due to lockdown restrictions, the Scottish tech industry experienced a boom. The level of deals closed in 2023 fell back to its 2020 number of 30. This does not necessarily imply a dip in the Scottish tech industry, but more likely points to the recovery of other sectors.

Figure 1: Total Deals Closed in Scotland (2018 – 2024)

All private equity and venture capital deals closed between January 2018 and February 2024, with a value over 1 million GBP and categorised under Information Technology (IT) , extracted from Pitchbook. Investments in digital healthcare services were not a part of this dataset.

Since 2018, there has been a steady increase in the value of IT deals closed. The average value surrounding deals closed at greater than £1 million has increased significantly, settling in at £6.97 million in 2023. We can speculate that the reason for the 2021 average being low is digital healthcare is not included in this dataset, and we know there was a boom of these throughout the pandemic.

Figure 2: Average Value of Deals per year

While data tells us the tech ecosystem is buoyant in Scotland, we know there are challenges faced by Scottish tech companies when it comes to scaling up. Specifically, it proves difficult to attain later-stage funding in order to properly scale up a company, something which the Scottish National Investment Bank is focused on supporting through our mission-led investment strategy. Talent retention can prove difficult in Scotland, especially when competing with larger tech hubs like London. However, as the Scottish tech sector continues to grow and startups move on to the scaleup phase, more attractive work opportunities will arise.

The Scottish economy is on a fruitful journey to overcoming these challenges. One example is the emergence of the space sector in Scotland which has fuelled technological innovation, driving advancements in areas such as advanced materials, robotics, AI, and software development, which have applications beyond the space sector. UK spaceflight company, Orbex, has just secured funding from a number of backers, including the Bank, in its series C round.

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.