Register for Free

Bookmark your favorite posts, get daily updates, and enjoy an ad-reduced experience.

Already have an account? Log in

Bookmark your favorite posts, get daily updates, and enjoy an ad-reduced experience.

Already have an account? Log in

By Stephen Gibbens, founder of Accountech,

and Angela Brown, founder of FinFlare

Scotland has a history of leading the world in inventions in the areas of medicine and engineering and is renowned globally for its innovation, with top-rated universities.

In recent years Scotland has built upon the existing strong tech ecosystem and an established investor network to further enhance its status as one of the best places in the UK to start a tech business.

A key factor in recent change has been the Logan Review, the Scottish government-backed review of the Scottish Technology Ecosystem, led by Chief Entrepreneur, Mark Logan in 2020. One recommendation has been particularly effective: the establishment of a national Techscaler network with seven tech hubs delivering world-class commercial education to startups.

Mark Logan also co-authored the Pathways Forward report with Ana Stewart and the resulting programme aims to transform gender inequality in entrepreneurship. The next generation of entrepreneurs are increasingly concerned with social impact, especially in the light of increasing evidence of climate change. Scotland has a great opportunity here as we have ample wind and tidal resources and a transition away from oil to manage.

Foreign students coming to study here, attracted by the renowned academic base and appealing lifestyle, often remain in Scotland and many have started tech businesses, creating an international and outward-looking diverse tech community.

Scotland has an established angel investment scene with mature angel syndicates supporting early-stage tech businesses. Combined with the Scottish Co-investment Scheme matching private investment and support from Scottish Enterprise through their SMART Scotland grants and SE High Growth Ventures programmes, this has helped to accelerate investment into our fast-growing tech businesses.

Events such as EIE24 and initiatives such as FORAS which funds founders to visit overseas investors and conferences have helped to showcase Scottish technology to the world and expanded the international ambitions of our founders. New funding initiatives have also emerged such as the British Business Bank’s £150m Investment Fund for Scotland, which offers debt and equity finance, and the British Business Investments’ Regional Angels programme which co-invests with established investors such as Archangels and Eos.

Additionally, the Northern Scale-Up Fund, an equity investment fund recently launched by Par Equity and backed by the Scottish National Investment Bank, seeks to bridge the funding gap from seed to Series A and beyond.

While the investment environment remains challenging for tech startups in Scotland, the ecosystem for creating and growing companies is transforming.

The support network for creating new tech startups is there – we just need investors who will support our best innovations as they scale and to better tell the story of the remarkable innovations that are happening in Scotland so that overseas customers and investors take notice.

UKTN surveyed key players in Scotland’s tech sector to generate an inside view of the ecosystem and represent the experiences of those running tech companies and support organisations.

Out of 72 survey respondents, more than half (56%) worked in or near Edinburgh, 25% worked in or near Glasgow and the rest were split across Dundee, Aberdeen, Stirling, Dumfries and Inverness.

The majority of respondents (58%) are tech company founders or owners, and respondents otherwise represented business support organisations, service providers, investors, tech event organisers and academics.

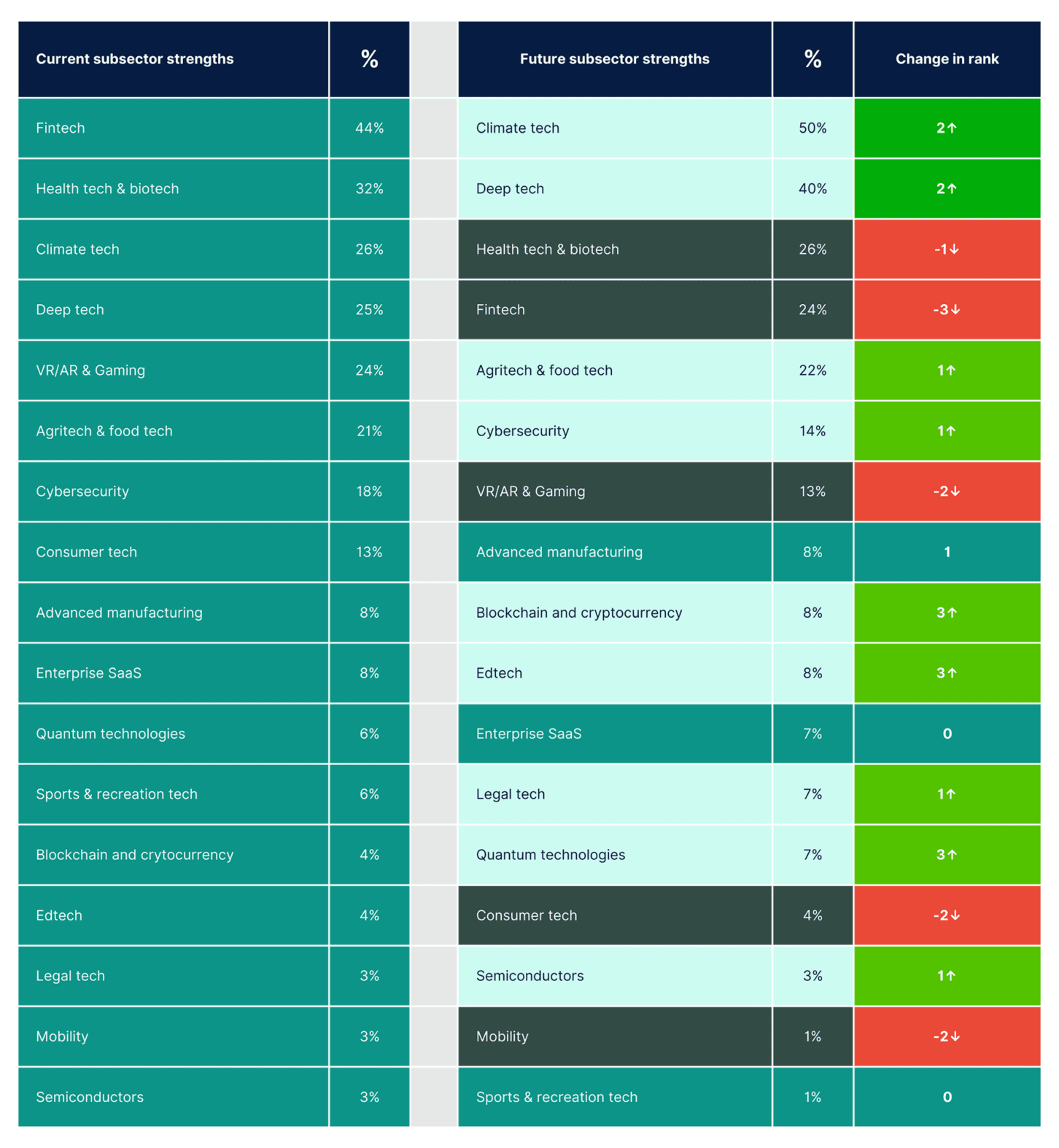

Scotland’s tech stakeholders ranked fintech the highest for current subsector strengths, followed by health tech (including medtech, biotech and life sciences). While fintech is generally considered an Edinburgh-specific strength, survey respondents said that life sciences is a Scotland-wide specialism with significant hubs connected to most of the country’s universities.

Climate tech and deep tech are both thought to be emerging specialisms – ranked highly for current strengths but predicted to become even more important in the future. Multiple people suggested a new subsector category which is becoming more prominent: geospatial technology.

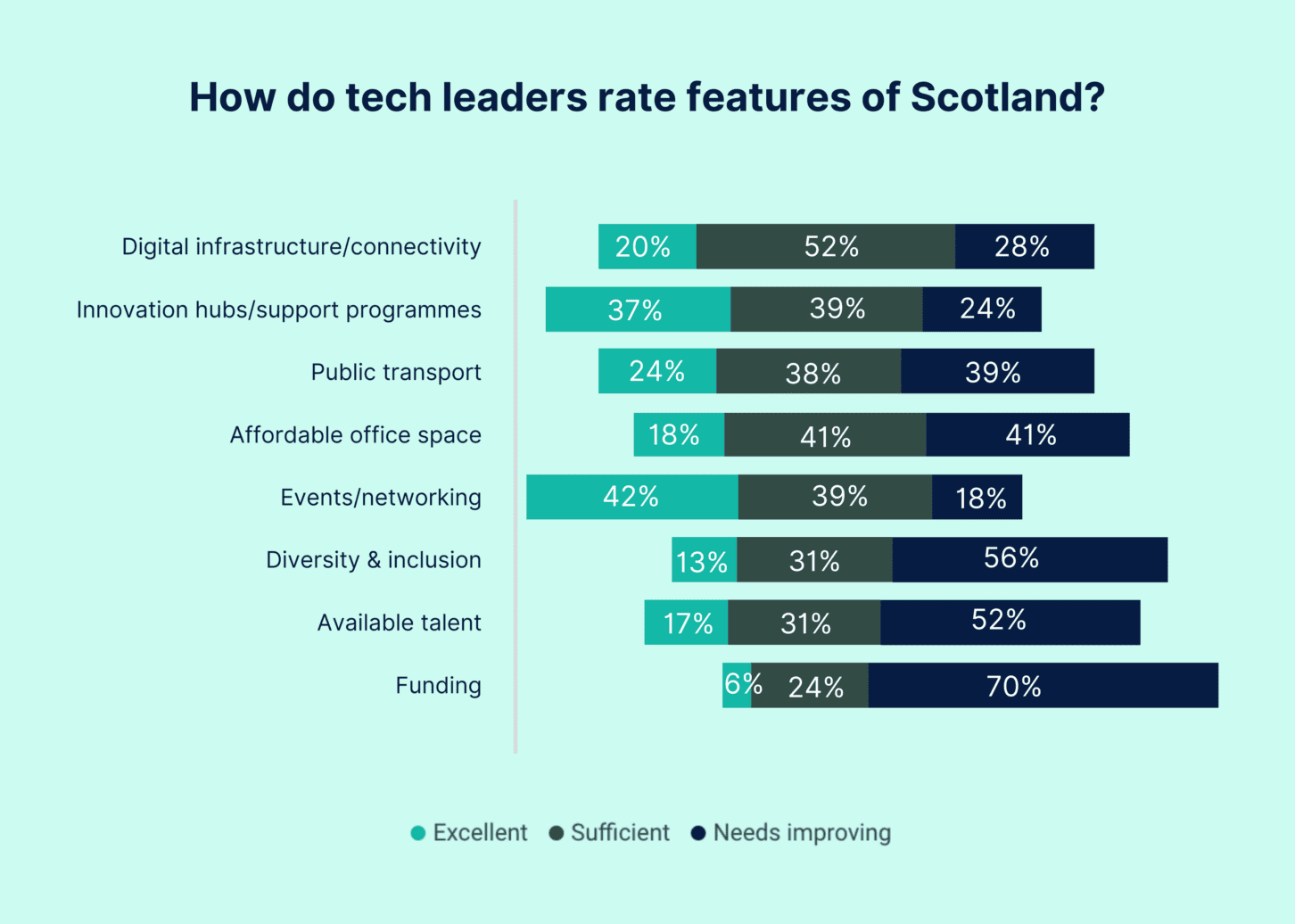

Given the number of events and networking communities named by respondents (46 in total, with the most popular suggestions featured in the ecosystem overview earlier in this report), it’s no surprise that this was rated the most favourable feature of Scotland’s tech ecosystem.

David Carboni, co-founder and CTO of Fife-based HairTracker, said: “It’s hard to measure, or overstate, the value in the quality of connection in this ecosystem. The atmosphere of supportive people, working for the good of all, is a massive asset and a credit to Scotland.”

However, diversity, talent and particularly funding availability received the lowest evaluations, with more than half of respondents saying these features need to improve. Multiple respondents commented that the lack of diversity (particularly with regard to ethnicity, sexuality and disability) is more noticeable in Scotland’s tech scene than in other places.

Concerns relating to available talent focused on skills shortages, including a lack of ‘green’ skills, and not enough focus on developing a strong talent pipeline from schools and colleges. Multiple stakeholders mentioned that more should be done to attract highly skilled people from abroad.

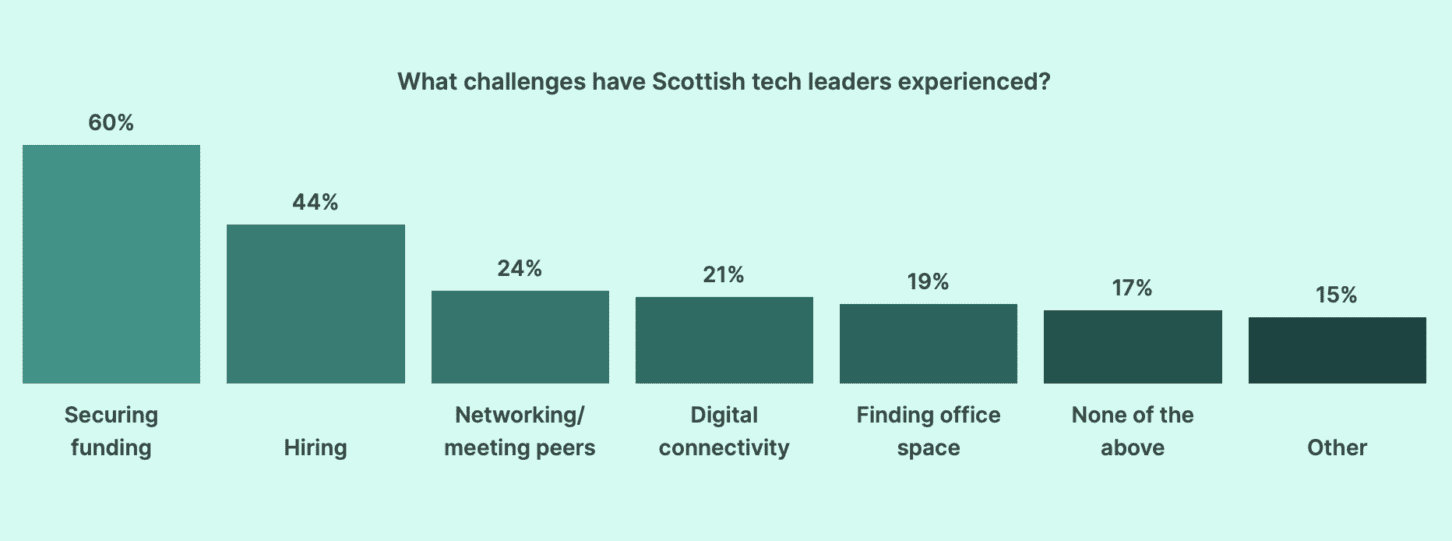

Almost a third of respondents said they have personally experienced challenges securing funding for their business. In addition to the already mentioned comments about a lack of growth-stage funding, founders also shared that it was particularly challenging for startups with a hardware element to find investment.

Multiple people also told UKTN that there’s a strong investment focus on university spinouts and ‘deep-tech’ i.e. research-led startups, but less funding earmarked for other subsectors. Aside from the challenges listed, the most commonly mentioned challenge in the ‘other’ category was a shortage of available lab space and manufacturing facilities. Market access is also a significant hurdle for growing startups – including finding customers within Scotland, recruiting users in Scotland to test products, and expanding to international markets.

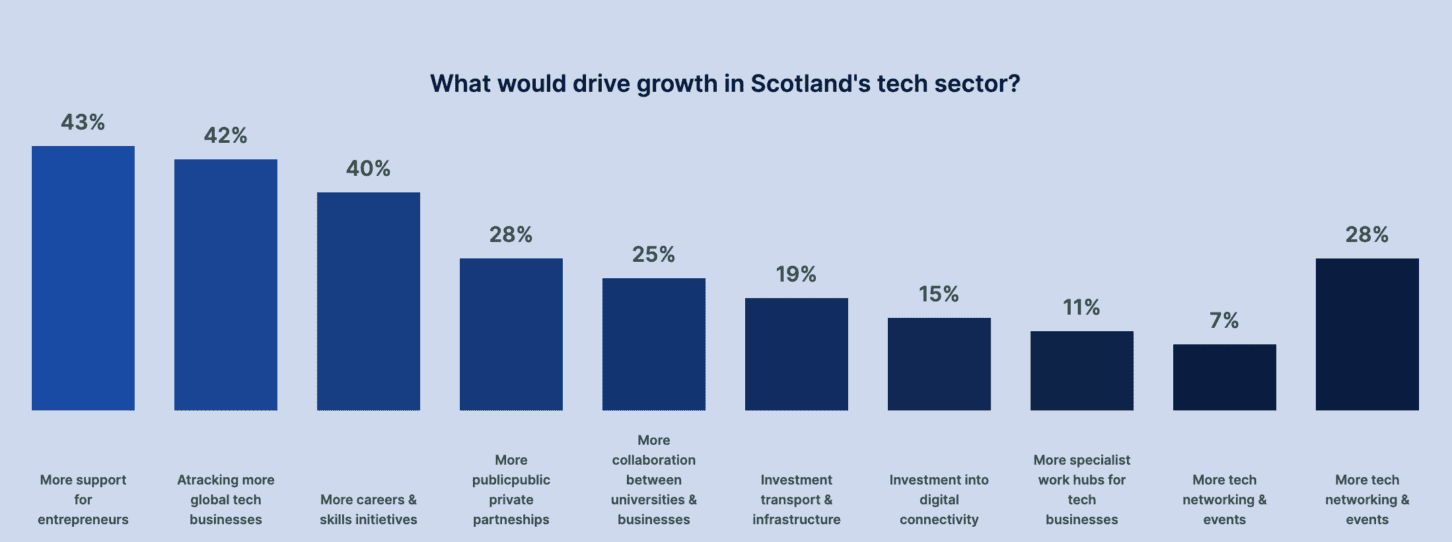

Though ‘more support for entrepreneurs’ was cited as the most popular factor that could drive tech growth, comments explaining this choice reveal that this reflects a range of ideas and views, including the need to shift the national focus to prioritise innovative technology over traditional industries and the fact that better infrastructure and connectivity beyond major cities in Scotland would enable more innovative businesses to set up and succeed.

Many respondents raised concerns about a mismatch between the skills required in the tech sector and the educational curriculum in schools and colleges, calling for initiatives to reform educational curriculums to meet skills gaps. Respondents feel that attracting more global tech businesses to Scotland could encourage more strategic partnerships across the tech sector and foster innovation, while encouraging growing businesses to stay in Scotland.

James Kergon,

senior partner – Scotland, KPMG in the UK

Following the impact of Covid and Brexit, the biggest challenge currently is economic uncertainty, we are seeing this hindering growth. A lack of skilled talent continues to be a challenge for Scotland given its size, in particular tech talent, and also C- suite/board level.

This is why a priority has to be luring people to work here and investing in education and training for people already living and working in Scotland. While there is plentiful support for early-stage tech businesses, more support is required for businesses that are trying to scale. We are beginning to see this develop with support from the private sector, public sector and universities

By Rich Wilson,

CEO and cofounder, Gigged.AI

We launched Gigged.AI in July 2021. I had spent 16 years working with large US based companies but apart from the successes of Skyscanner and Fanduel I knew very little about the Scottish startup scene.

Initially we had planned to have our main location as London as the perception was that it would give greater access to large clients and capital. However, there was a buzz starting to build in Glasgow, mainly due to the tech hubs of large organisations which were our target client base. Glasgow also has amazing universities that we could recruit from. So we decided to make Glasgow our home base and take the four-hour train to London (when not on strike).

Below is my firsthand experience of the ecosystem of the last two and a half years and I am glad to say our experience has been largely positive. Here are the main parts of the ecosystem that helped Gigged.AI:

The Data Lab is Scotland’s Centre for AI and Data. The support we had was invaluable, whether that be technical advice, support or funding. The funding service helped us gain our first grant from Innovate UK which allowed us to build the early AI models we needed to be credible. Our grant writing skills were poor and this service helped us turn a failing application into a successful one.

Innovate UK has a good history of supporting Scottish companies. We managed to secure £95k of grant funding as part of the Sustainable Innovation fund and this was really the catalyst for us. Without this grant I doubt we would have survived as we found grants in Scotland were in short supply.

We decided early that we would only look to be part of one accelerator. This was definitely the right choice. Katy Guthrie has built a great accelerator which helped us specifically with improving our design with the support of Nile HQ who later became an investor. It is definitely one of the best in the UK.

Again, we decided not to apply for every startup competition but felt Scottish Edge would help build our brand. We were successful on our second attempt and it was a great experience for us and put us on the radar of potential investors.

We came to the attention of Scottish Enterprise through Scottish Edge. Our early applications for grant funding but we were then successful on becoming a High Growth potential company. The support has been first class, whether that be advice, introductions or grant funding.

This is something that is not spoken about as often as it should. In Scotland there are large companies with huge tech teams that are willing to support startups. Companies that we have found to be very supportive include Insights, Morgan Stanley, Barclays, NatWest, Lloyds, Aggreko, Wood Mac and Fanduel.

Early-stage funding in Scotland is actually very strong. We were supported by incredible angels like John Brodie in the very early days. Our pre- seed round was led by Techstart and our Seed round was led by Par Equity, both have been very supportive. There is obviously a lack of companies that can support Series A and beyond but the recent news of major new growth funds by Par Equity and Maven should help this.

This is often looked down on but there is an amazing number of successful Scots in the US who are happy to support as you need it. I have had amazing support, in particular from Steve Kennedy who is in San Francisco and Lesley Eccles (Co-Founder of Fanduel) who is in New York.

By Di Gilpin,

CEO and founder, Smart Green Shipping

It’s no secret the Scottish government has recently faced backlash because of its decision to scrap the target to cut carbon emissions by 75% by 2030. But Scotland is still a great place to start an early-stage innovative climate technology company – as I can attest to from my own experience. Scotland has a great deal of initiatives in place to fund and support first movers and a lot of ambition and collaboration, including the citizens’ Climate Assembly, designed to engage the public in making decisions to tackle climate change.

Scotland recognises that investing in green business is a good investment. The long game is clear – we must create a new green future, and even if targets change, decarbonisation will happen and places and people who embrace that will be winners. There is money to be made and that means more jobs and better outcomes. Scotland’s Green Investment portfolio includes over £3.7bn of investment opportunities across low- carbon energy, power and fuel, low-carbon transport logistics and distribution, eco-friendly business space, circular economy and recycling, innovation and technology.

By Thomas Gillan,

CEO of Edinburgh-based fintech BR-DGE

BR-DGE is proud to be based in Edinburgh and home to a number of excellent colleagues who are pioneering the next wave of innovation in financial services and payments. Key to our growth in recent years has been tapping into the vast talent across Scotland and the UK which has enabled us to build products, grow our offering and win trusted clients. This level of talent and skill is a key competitive edge for Scotland that we need to continue to further embrace and develop in the future.

Yet, talent alone is not enough to power the next generation of tech leaders in Scotland. One area in particular that needs greater focus is startup investment. While there is a rich pool of angel investors and VCs focused on early-stage companies in Scotland, there is a much smaller group of local investors at a later stage in the startup cycle (Series B+). This lack of later-stage funding is a key barrier for firms looking to grow into new markets and scale their operation who need the investment to take their business to the next level.

This also means that many Scottish founders have to focus more on London and its larger pool of investors so that they can receive the investment required. It is unsurprising, but equally concerning, that every UK fintech unicorn is now headquartered in London. This later-stage funding gap is an issue that must be rectified if we are to establish Scotland as a global hub for tech innovation. The alternative is that ambitious founders could be pushed to choose a headquarters outside of Scotland.

Two years ago, I was privileged to join a delegation of 20 Scottish tech entrepreneurs for a tour of Silicon Valley. I saw first-hand how our country is a melting pot of new tech ideas and ambitious founders who want to create real impact in their individual areas of specialism. These events fill me with confidence and show that there are vast opportunities for Scottish entrepreneurs on the global stage.

To realise this ambition, we need to go further in creating a hub for future tech leaders. Part of this is self-belief and being more proactive in shouting about the successes of Scottish tech firms and the ecosystem. The other part of this is ensuring we have the right foundations in place as a country to ensure founders can thrive whether that be through talent, investment, or startup incubators.

As we have experienced at BR-DGE, the Scottish startup ecosystem is supportive and there is a will to support new local tech firms and founders. The challenge, however, lies in ensuring these companies are seen through to maturity. By addressing these challenges, only then will we be able to ensure the ecosystem’s success stories aren’t sporadic and Scotland is a ‘forever home’ for innovators.

I am convinced that this is possible and we can build on our successes in recent decades. But this will only be achievable if we all work together to solve these issues and truly establish Scotland as a global tech hub.

Emerging Giants lead – Scotland, KPMG in the UK

Scotland needs to be bold, and shout about our brilliant tech talent. We are often known for ‘getting on with it’ but we’ve got a great brand and fantastic founders to showcase to the world.

VC investment continues to drive growth in our best tech companies. As a result of the current challenging climate, we have seen investments drop (a UK-wide trend), so a focus on sustainability is key to see founders through to an uptick of VC investment.

Secondly, we need to wrap the right support around our talented founders, ensuring they get the best talent in to drive the growth of the business, or can upskill themselves. Firms like ours can support with building the right team, including board and non-exec directors, to help shape the growth of the business.

True False

True False

True False

True False

True False

True False

True False

True False

True False

True False

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.