Register for Free

Bookmark your favorite posts, get daily updates, and enjoy an ad-reduced experience.

Already have an account? Log in

Bookmark your favorite posts, get daily updates, and enjoy an ad-reduced experience.

Already have an account? Log in

In the last few years, distinct tech clusters have emerged in the North East and dedicated groups have been set up to ensure the region’s potential in these areas is supported and directed with appropriate strategies.

For example, CyberNorth is spearheading the organisation of the North East’s cybersecurity ecosystem, and FinPact launched in 2023 with a mission to promote the region’s progress through collaboration, innovation and a focus on digital, data and tech skills to drive fintech growth. Sunderland Software City’s Immex City project aims to bring together the immersive technology cluster and support the upskilling needed to develop further.

While this represents encouraging developments, stakeholders in the region remain concerned about the availability of and access to funding needed for innovative, ambitious North East businesses to scale.

Multiple well-connected tech leaders in the region told UKTN that the investment landscape in the North East – with low levels of venture capital funds available or accessible – has created a distinct culture among entrepreneurs. On the positive side, tech founders are more inclined to ‘put their heads down’ and achieve significant milestones while bootstrapping, but stakeholders also noted that founders were more inclined to accept unfavourable investment terms and less likely to proactively explore fundraising opportunities.

Steve Grainger, founder and managing director of Newcastle-based digital agency Enigma, believes that the characteristics of the North East’s tech scene – including the relatively low investment activity – create both advantages and challenges for businesses’ growth ambitions.

He says: “A real strength is the independent nature of the sector. We don’t tend to have so many large, established corporates draining away the digital talent, so this allows smaller, more market-focused businesses to flourish and grow. These businesses are agile and able to rapidly pivot and innovate in a way that the larger corporations are simply not able to do.”

“Because the North East hasn’t historically had a large investment community, startups have had to be leaner and much more focused on revenue-generating opportunities, rather than just chasing funding rounds. This has meant tech startups here tend to be leaner and smarter, but perhaps are ultimately hampered when it comes to long-term, large-scale growth”

“That’s changing now and out-of-region investment houses have become aware of the opportunities here, and it will be interesting to see how that changes the landscape over the next few years”

Caroline Churchill,

partner,

Womble Bond Dickinson

Access to capital is one of the largest obstacles that North East companies are met with. Regardless of the region’s potential, it appears that investors continue to focus on the South East, making it difficult for tech and data businesses in the North East to secure sufficient funding. To reduce these barriers, encouraging investors to look beyond the South and consider opportunities elsewhere will be a key factor in promoting the digital sector in the North.

As well as an established regional infrastructure and vibrant workforce, the North East can offer qualities that the majority of other regions are unable to. With significant levels of untapped opportunity and success stories yet to be heard, we can certainly help tech and data companies understand and reach their full potential.

The region’s strong communities and regional identities are both a strength and a challenge for the tech sector. On the one hand, stakeholders overwhelmingly agreed that the “community feel” enabled a culture of openness and helpfulness, where informal advice and support is always available with no strings attached.

But on the other hand, the strong territorial identities – not just confined to football rivalry – coupled with the distribution of resources across different regional authorities, have also led to unnecessary divisions and challenges for those trying to access support, funding and partnership opportunities.

Already, initiatives are in the works to unify the region’s tech ecosystems, including a strategic partnership strengthening the innovation offering between four of the region’s universities.

Stakeholders are generally hopeful about the devolution deal which will bring together seven local and city authorities (already organised into two combined authorities) and grant the overarching North East Mayoral Combined Authority greater control over funding, local decisions and infrastructure.

Caroline Churchill,

partner,

Womble Bond Dickinson

The North East has a unique set of strengths that distinguish it from other regions in the country. We have the five universities (Newcastle, Northumbria, Sunderland, Durham and Teesside) leading at the forefront of technological innovation have created a plethora of talent waiting to be utilised.

The region is also home to a closely-knit business community, with various clusters, networks and partnerships such as CyberNorth, Dynamo and the North East Chamber of Commerce fostering innovation and collaboration. The low startup costs associated with the North East help create a fertile environment for opportunity and growth. The North East is a prime location for tech and data businesses to call home.

Despite the North East’s density of STEM students and graduates, attracting and hiring talent across all levels of seniority is a challenge for tech companies in the region.

The rise of remote working during and since the pandemic has disconnected salary expectations from regional cost of living; a small business in the North East is tapping into the same global talent pool as a tech company in California, so even when North East businesses want to hire locally, there’s pressure to offer a data scientist in Newcastle, for example, the kind of salary they’d be offered by a company based in a larger, more expensive city. Many early-stage startups in the North East simply cannot compete.

Jamie Hardesty, director of communications and ecosystem development at Sunderland Software City, says that the talent problem is compounded by the fact that the region is broadly nascent. Where other regions produce greater multiples of established digital tech companies, boast significant exits and serial entrepreneurs, the North East has a volume challenge.

He says: “Without those exits, serial entrepreneurs and tech companies which employ thousands of people, we effectively have a small ecosystem to hire from which makes it hard to access skills across all levels, and creates a leadership challenge for growing companies too. This is something we’ve been working hard to address, it’s a challenge not unique to the North East but we believe our close-knit community can collaborate to offer unique support solutions.”

Nonetheless, the ingredients are already in place to ensure the North East can make the most of its workforce, through university initiatives, skills programmes and an increasing number of high-growth startups.

Graham Lowes,

area director,

Newcastle and Northumberland,

Lloyds Bank Business & Commercial Banking

As with many regions outside of London and the South East, access to funding and investment remains a challenge for the region and its growth ambitions in the tech space. In addition to London, there is also a risk of the North East falling behind other regions such as the North West when it comes to investment in scaleup tech businesses.

Whilst talent is a true strength across our cities, the post-pandemic remote and hybrid nature of many tech roles means that our firms also face a challenge in retaining this talent locally, competing against businesses based in London and driving up salary costs as a result. Further building the close collaboration and connectivity between our cities will be key for the North East in overcoming these challenges and continuing to grow in the tech sector in a joined-up way.

UKTN commissioned Censuswide to survey 100 senior managers at technology companies in the North East, to explore how the tech community currently views the region’s tech sector and represent the experiences of those running tech companies across the North East.

Survey respondents represented a natural spread across specific locations in the North East, gender and age. The majority of respondents (71%) worked at tech companies with at least 100 employees, so the following views are more accurately taken as those of established tech companies rather than early-stage startups.

Sam Baldwin,

technology sector director,

Lloyds Bank Business & Commercial Banking

There are a number of developments making the North East a thriving tech ecosystem. One of the most exciting is the growth of the immersive tech subsector, born out of the region’s strength in gaming. As metaverse technology becomes more widely utilised, the North East is well-positioned to capitalise on the opportunity.

Growth opportunities also exist across other subsectors, for example in the fintech space where we are seeing an emergence of a payments specialism across the region.

Excellent Sufficient Needs improving

Jennifer Hartley,

director,

Invest Newcastle

The North East faces similar challenges to other parts of the UK in terms of access to talent and funding, but these are being addressed from every angle, from organisations such as ourselves, working to attract foreign direct investment and private capital, to support networks who are equipping local companies with the resource they need to succeed.

Cost of living

59%

Hiring

33%

Secure funding

30%

Travel around the North East

28%

Digital connectivity

23%

Office space

21%

Networking/ meeting peers

21%

Expanding beyond the North East

19%

Diversity & inclusion

18%

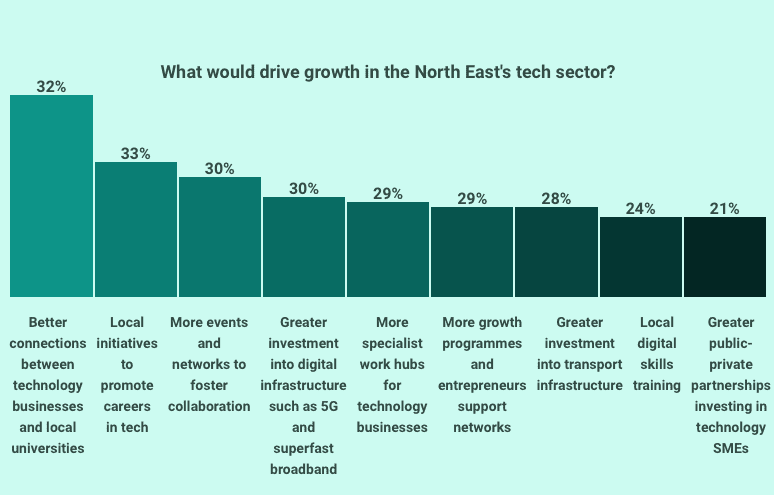

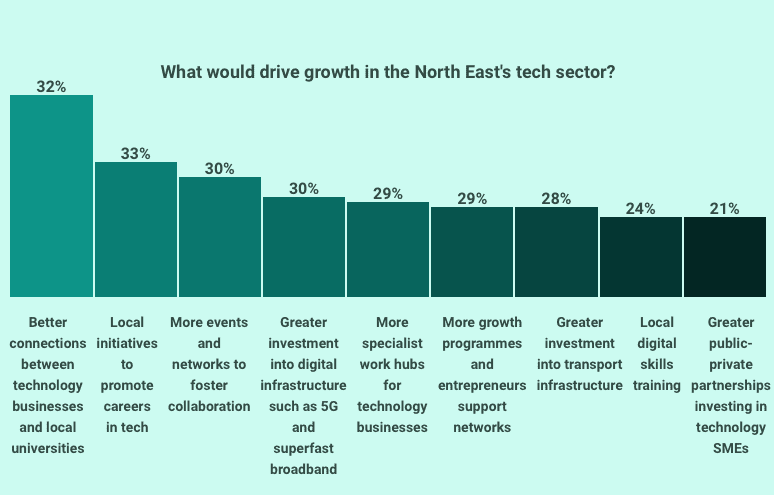

Better connections between technology businesses and local universities

32%

Local initiatives to promote careers in tech

30%

More events and networks to foster collaboration

30%

Greater investment into digital infrastructure such as 5G and superfast broadband

30%

More specialist work hubs for technology businesses

29%

More growth programmes and entrepreneurs support networks

29%

Greater investment into transport infrastructure

28%

Local digital skills training

24%

Greater public-private partnerships investing in technology SMEs

21%

Dawn Dunn,

digital and tech sector lead,

Invest Newcastle

We are seeing the region emerge as a hub for research and development, with companies locating in the city to exploit the local talent pool to generate IP and build sustainable business models.

True False Don't know

True False Don't know

True False Don't know

True False Don't know

True False Don't know

True False Don't know

True False Don't know

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.