Banco Santander has announced the launch of PagoFX, a low-cost international money transfer service, in the UK.

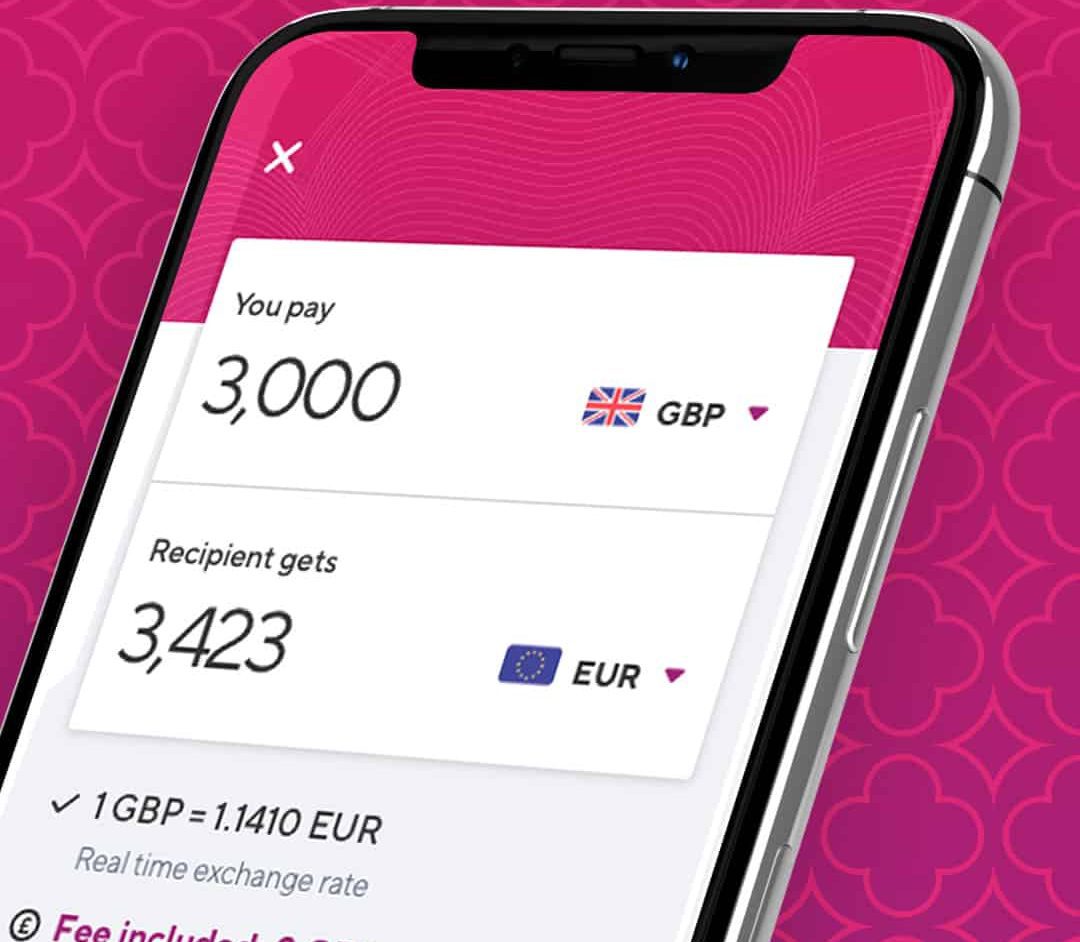

This new service, available via a mobile app, allows UK residents with a debit card issued by any UK bank or financial entity to seamlessly and quickly send money abroad from their smartphone with low costs, bank-level security and customer support via in-app chat, web and e-mail.

In light of the ongoing coronavirus pandemic, PagoFX will allow customers to use the service to transfer money abroad without any fees at all for the next two months.

PagoFX, which works as an autonomous fintech start-up with more than 50 people in Madrid, London and Brussels, brings together the best of both worlds through an easy-to-use app: Santander’s expertise in international payments, foreign exchange and high security standards, with the digital innovation and competitive pricing of the fintech sector.

Ana Botín, Group executive chairman of Banco Santander, said: “PagoFX makes it possible to transfer money internationally easily, at low cost, and with the security and peace of mind that comes from a regulated entity backed by an international bank. This is a unique proposition and we hope it will help many people and businesses.

“It draws on our world-class technology and talent to deliver a new and highly relevant service for everyone in the open market.”

The launch is another milestone in Santander’s four-year (2019-2022), 20 billion-euro digital technology pledge. Payments are a cornerstone of the banking group’s open financial services platform, being delivered to create fast, simple and safe digital services for consumers, merchants and SMEs around the world.

Capitalising on successful and proven technologies, PagoFX is the open-market version of Santander’s existing international money transfer service One Pay FX, which offers transparent and quick international transfers to its bank customers in key countries in Europe and the Americas.

The service will be rolled-out to sole traders and small-and-medium-sized enterprises in the UK via the PagoFX website and mobile app in the near future. In addition, PagoFX will be launched in other European countries later this year and be present in around 20 markets in the next three to four years.

As a fintech start-up, PagoFX has attracted talent from several big tech companies, such as Amazon, PayPal and Intuit, and start-ups, and works together with the strong global payments team at Santander, which includes executives with digital and banking backgrounds.