Plum, the smart app for managing money with more than 1m users in the UK, reveals data to show how UK consumer saving behaviour has shifted in 2020.

With the lockdown due to COVID-19 being the period of steepest growth, Plum has seen a huge spike in money saved during the year to date.

The total money saved by Plum for users has increased by 5x since the start of January. This is the total amount of money saved by Plum users by the end of May, taking into account money withdrawn as well as money deposited.

Plum’s AI algorithm responds to each user’s individual income and outgoings, setting aside affordable amounts every few days. The increase in net money saved shows that, on average, people have been spending less and have not needed to dip into their savings, meaning the Plum algorithm saves larger amounts each time.

There is also evidence that many people are using lockdown to actively stash away funds wherever they can. For example, Plum has noticed a 163% rise in utility switches during the first five months of 2020.

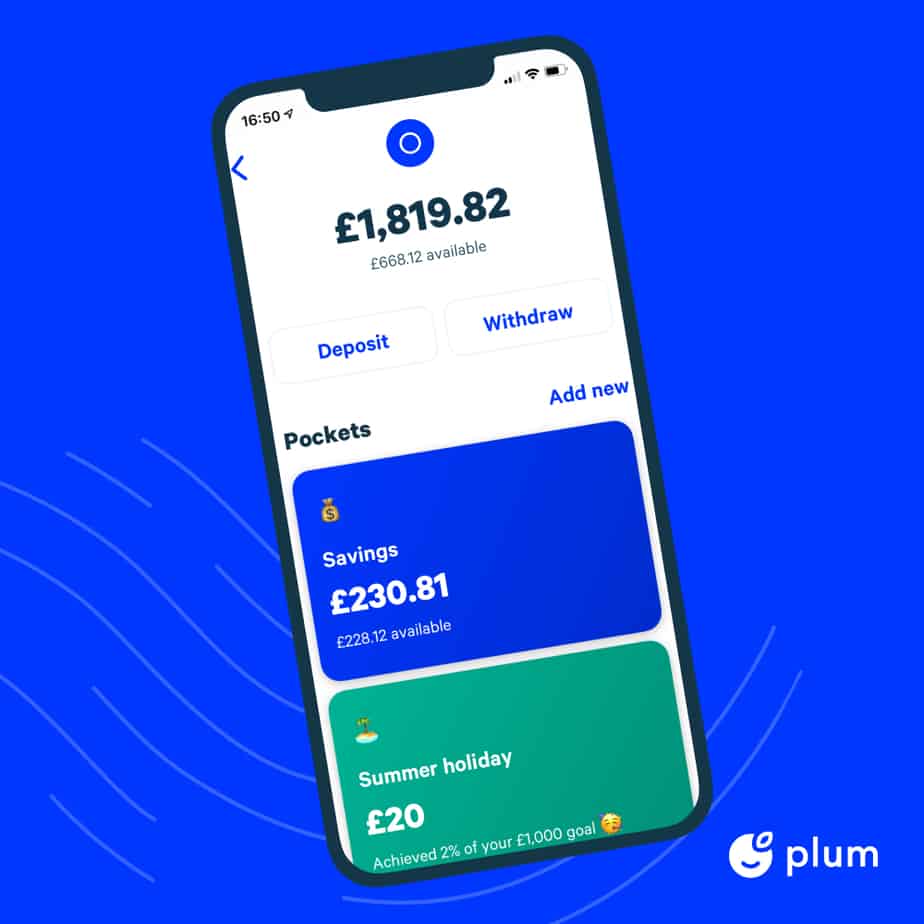

Victor Trokoudes, CEO & co-founder of Plum comments: “Plum is automated finance in action. Our algorithm makes decisions that benefit you in the long run, like automatically saving a lot more when your spending drops significantly.

“With that money safely stashed away, our users are financially resilient, whatever life throws at them. And this means they can make their life goals a reality.”