By now it is well documented that it has been a rough period for “new” technology in the public markets. Just Eat and King are leading British names that have suffered lacklustre IPOs recently, perhaps only one or two months too late to enjoy an opening surge.

Yet their fate has been nothing compared to the darlings of 2012 and 2013. Names like Splunk and FireEye, US analytics firms far more sophisticated than their names might suggest, both saw their shares nearly cut in half in the turmoil of recent weeks.

Back on bubble watch

After a brief respite last week we are back on bubble watch again. David Einhorn, a big fish Hedge Fund manager in New York, told his investors in a letter this week that we were witnessing the “second tech bubble in 15 years”.

So it is refreshing to get back to the real world this week with the beginning in earnest of first quarter earnings season.

With Easter falling when it did Wednesday evening was the biggest earnings night in tech I can remember. Amongst the big names Apple, Facebook and Qualcomm were all reporting their numbers.

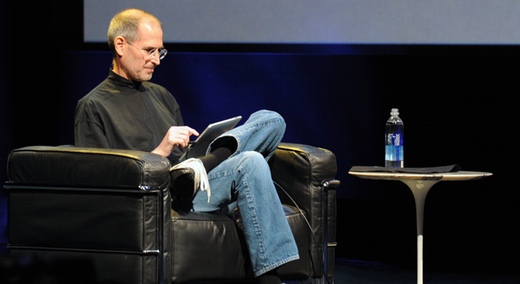

It is difficult to sat whether Apple fits into the “new” or “old” tech camp. It has certainly been performing like old tech over the last few years, and yet this is a company that did as much as anyone to usher in the mobile revolution that has spurred so much innovation.

Last night they reported very strong iPhone sales, 43m so far this year, up 16% on the previous year.

Last night they reported very strong iPhone sales, 43m so far this year, up 16% on the previous year.

On the other hand iPad sales fell between 3% and 16% depending on how you do some wonky inventory maths.

Still no new products to speak of, although they are increasingly offering something many investors are excited about: cash.

Wednesday night they added another $30bn to their $100bn cash return program. Given that they produce around $70bn of so-called free cash (cash after expenses and spending plans) they have scope to do even more.

Facebook is definitely in the new tech camp, and whilst I notice there is a sense of fatigue with the platform in an anecdotal sense, the hard numbers suggest we are as engaged as ever.

You might not like them, but Facebook’s ads are winning

On average we are all using Facebook on 70% of days. What’s more, the value of advertising within the platform is exploding. Put aside your British cynicism; we might not like being sold to but the rest of the world has no such problem.

Advertising dollars for Facebook increased 82% over the previous quarter last year. The advertising from each user also increased 58%. On mobile growth is still in the triple digits. Someone is clicking a lot of those adverts.

So for all it might not fit our own experience, the hard numbers show Facebook is making good on its promise to be the leader in targeted advertising.

The truth about engagement is that, they probably have all the data they need already. It is no surprise that it was reported this week that they may launch their own ad network. It is hard to imagine anyone better placed to succeed.

But perhaps the wider message is that social, mobile, cloud and data are real trends producing disruptive businesses that make hard dollars.

The question of how much to pay will come and go, but the companies themselves are here to stay.

image credit: shutterstock/wikimedia commons