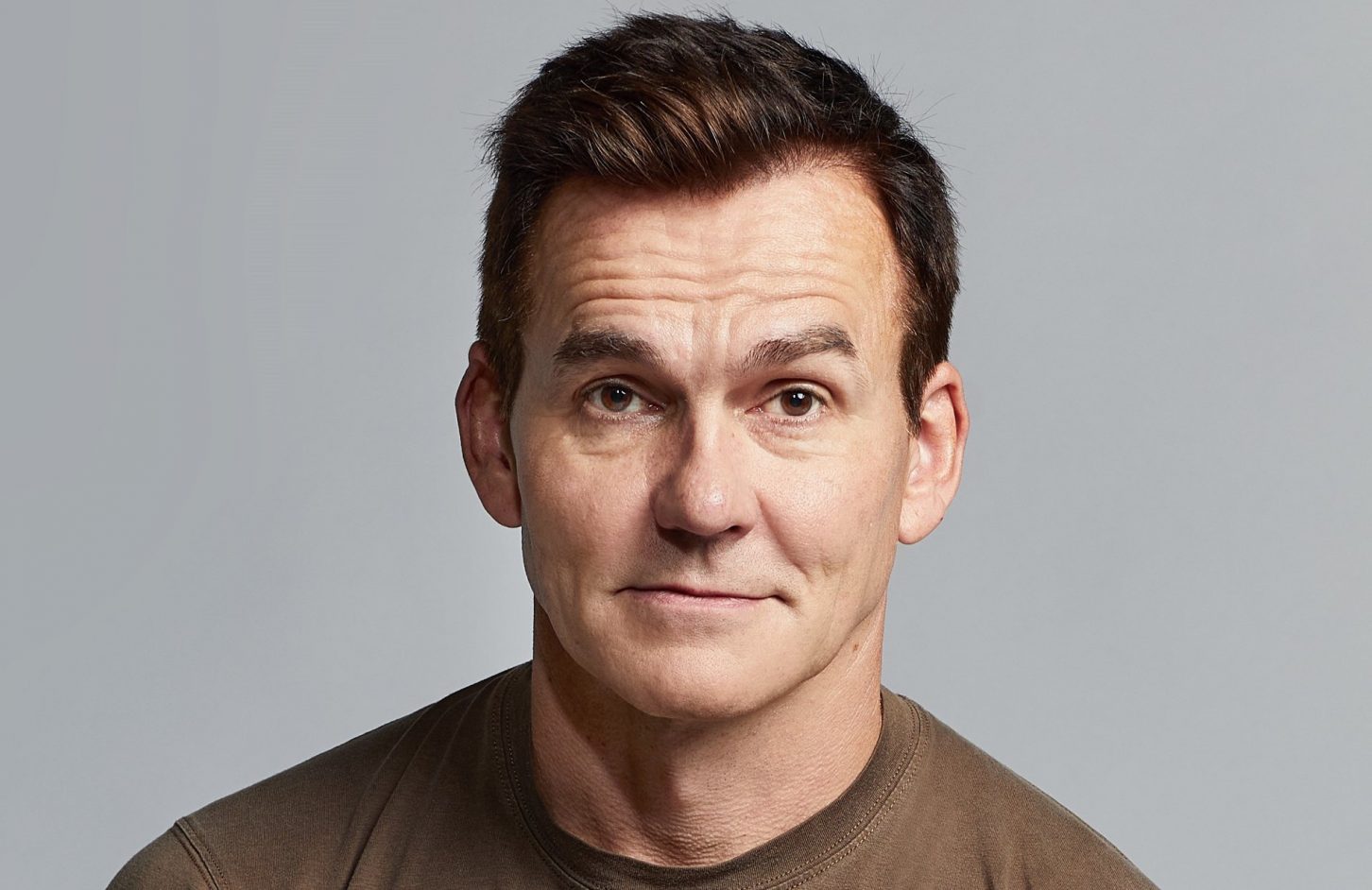

THG founder and CEO Matthew Moulding has called out a US hedge fund for short-selling Darktrace in a post criticising a lack of protections for publicly listed UK companies from “rogue investment bankers”.

Writing in a LinkedIn post, Moulding took aim at US-based hedge fund Quintessential, which held a short position on Darktrace and published a critical report about the British cybersecurity company in February that sent shares crashing to a record low.

Quintessential’s report said it was “deeply sceptical about the validity of Darktrace’s financial statements” and accused the company of potentially fraudulent practices to artificially inflate sales.

Last month, a review by auditor EY found no evidence of accounting fraud. Moulding said that Quintessential’s report was “filled with wild allegations of corruption” and that EY’s report showed Darktrace “is a UK tech darling after all”.

Quintessential hit back at Moulding with its own LinkedIn post on Saturday. It said that the “acknowledgement of irregularities and areas for improvement in Darktrace’s systems, processes, or controls further emphasises the legitimacy of our concerns.”

‘Reads like sour grapes’

Quintessential told UKTN that Moulding’s assertion that the hedge fund closed its position within 48 hours of publishing its report is “completely false”.

A tracker, shared by Quintessential, shows the hedge fund increased its short position in Darktrace until the publication of its report on 31 January, then gradually reduced its short stake throughout February.

The last documented position is on 16 February at 0.38%. A Quintessential spokesperson told UKTN that it “still had an open position at the end of the month and beyond”, but it fell below the reportable threshold.

“While we understand THG’s frustrations regarding short sellers, it is essential to recognise the vital role that short selling plays in market efficiency and price discovery,” Quintessential wrote in its post.

“The short thesis on THG’s stock, validated by a significant drop in its value, might reflect underlying concerns that cannot simply be attributed to malicious intent.”

Moulding, who took time out of his holiday to spar with the hedge fund, replied: “Trying to argue your actions against LSE companies are a force for good is like a house burglar arguing he’s helping to de-clutter homes.”

In a separate reply, Moulding added: “Reads to me like sour grapes”.

During the war of words, which was first reported by Business Cloud, Moulding highlighted what he sees as a disparity between US and UK authorities when it comes to protecting their markets.

Moulding said: “If the London Stock Exchange is to ever pull out of its death spiral, then the UK needs to follow suit. A lack of action only feeds global sentiment that London is a backwater, a soft touch, where rogue investment bankers and hedge funds go unchecked in plundering the market for personal gain.”

THG declined to comment when contacted by UKTN.

Moulding founded THG, formerly The Hut Group, in 2004. The Manchester-headquartered ecommerce company floated on the London Stock Exchange in 2020 in what was then largest UK IPO since 2013.

Last month, THG acquired City A.M. in a deal that saved the business newspaper from administration.

– Story updated to include extra details on Quintessential’s short position.