Register for Free

Bookmark your favorite posts, get daily updates, and enjoy an ad-reduced experience.

Already have an account? Log in

Bookmark your favorite posts, get daily updates, and enjoy an ad-reduced experience.

Already have an account? Log in

September 2024

September 2024

Sponsored by

I’ve spent years working in innovation ecosystems from Manchester to Massachusetts, yet what is very special about Cambridge is its track record in creating discoveries and building businesses that change how we think and live. Cambridge is the fastest-growing city in the UK and is home to the most intensive science and technological cluster in the world with 6,379 patent applications and 35,000 scientific articles published per million inhabitants over the last 5 years.

We have a mature and thriving tech ecosystem, representing 18% of the entire UK ecosystem ($191 billion) according to Dealroom and for every venture dollar invested, the city returns 17, ahead of the UK (5.4x) and London (4.8x). This is thanks to the over 5,000 innovation-driven businesses and globally recognised companies that call this city home, including Raspberry Pi, Darktrace, AstraZeneca, Exscientia, Healx, Quantinuum and Nyobolt.

The Oxford and Cambridge regions make a significant contribution to the UK tech industry, with their universities fostering a world-class talent pipeline and generating numerous spinouts.

We are delighted to see UKTN spotlight these regions, highlighting both the successes achieved so far and the ongoing potential for businesses, investors, and talent. It’s no surprise that subsectors like life sciences, Artificial Intelligence, and quantum technologies are thriving here.

We believe that enhanced infrastructure, such as lab space and transport links, will drive future growth. However, strengthening partnerships across the ecosystem remains crucial for continued success in these regions. Collaboration is key, and we look forward to continuing our work with businesses in these areas.

Featured alongside London as part of UK tech’s ‘golden triangle’, few places on Earth carry the technological esteem held by Oxford and Cambridge. And the reputation for tech innovation in the two cities is more than backed up by the numbers.

Research from Dealroom in 2024 found that the Cambridge tech industry alone accounted for 18% of the value of the entire UK tech industry, and last year startups in the two cities attracted more venture capital funding than anywhere else in Britain outside of London. So far this year, Oxford and Cambridge firms have raised around £587m from investors in a period of slower tech investments globally, according to data provided exclusively for this report by Beauhurst.

The two cities are arguably best known for their universities, which rank among the best in the world. Combined, the universities of Oxford and Cambridge boast almost 1,000 years of academic excellence. Today, that excellence is as strong as ever, with the universities supporting a world-class talent pipeline to the specialist industries that thrive in the cities.

The University of Oxford and the University of Cambridge are the two most prolific generators of spinout companies in the UK, responsible for the formation of over 300 British businesses. Oxford and Cambridge have both produced global tech firms, from Cambridge’s Arm – which had the biggest IPO in the world in 2023 – to Oxford Nanopore Technologies, which revolutionised DNA and RNA sequencing.

Among the most prominent tech subsectors found in Oxford and Cambridge are life sciences, cybersecurity and artificial intelligence. The region is also at the forefront of the rapidly developing British quantum computing sector, with startups such as Riverlane, Nu Quantum and Quantinuum – formed out of a merger between UK-based Cambridge Quantum Computing and US-based Honeywell Quantum Solutions – leading the way.

There is a long-running rivalry between the cities’ two universities that extends beyond the annual Boat Race. However, there are many initiatives aimed at driving greater collaboration between the Oxford and Cambridge tech ecosystems, and unlocking economic growth in adjoining counties. The cities contain numerous science and tech hubs formed to house companies and encourage deeper tech collaboration such as the Oxford Centre for Innovation and Cambridge Science Park.

Dan Mills,

Cambridge Tech Relationship Manager, Lloyds Bank

With a history of technological innovation spanning the University of Cambridge’s entire almost-800-year history, and now leading the way in the AI arena, the region’s status as a key contributor to the UK’s tech strategy and the part it has to play over the coming years is unparalleled.

Source: The Oxford Trust

Source: The Oxford Trust

Source: Beauhurst

Source: Beauhurst

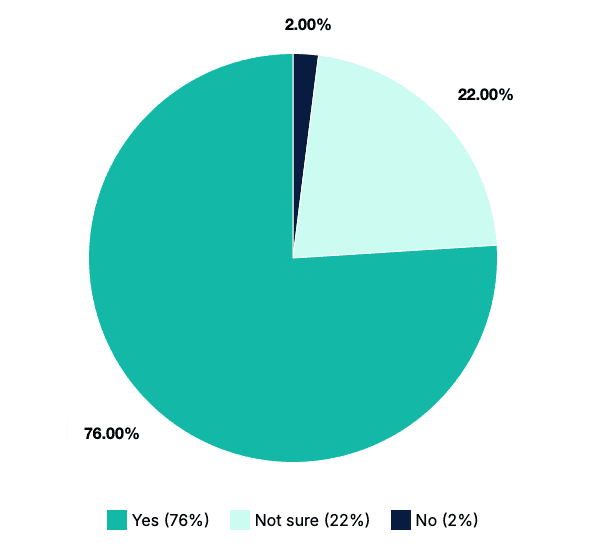

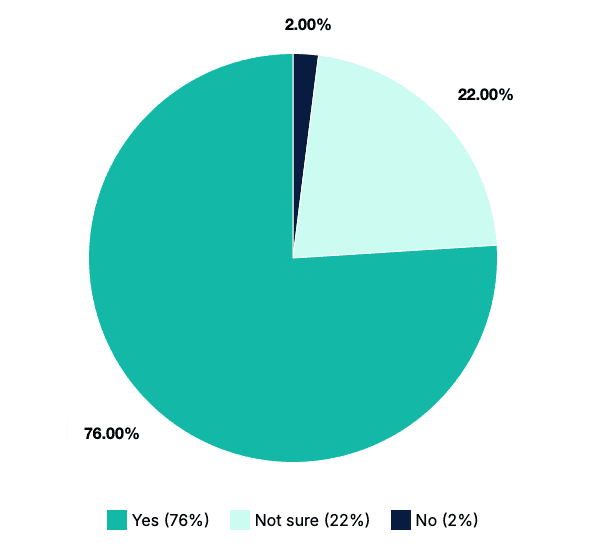

Source: Cambridge Network

Source: Cambridge Network

Source: Beauhurst

Source: Beauhurst

The Oxford-Cambridge arc

The group claims the suggestion that investors, businesses and policymakers should consider the arc as a “one-economy entity”, rather than three or four distinct economic areas was flawed.

The arc project received further government support under Rishi Sunak. In the 2023 Spring Budget from Jeremy Hunt, the government announced it would confirm plans for a Bedford-Cambridge rail route. The budget also promised an increase in the available supply of “commercial development” that is “key to supporting R&D needs” in the “Oxford-Cambridge corridor”. Increased lab space in particular was highlighted as a priority for the region.

Stop the Arc Group trustee Nick Burton described the idea as a failure in August 2024. Burton said the concept of an Oxford-Cambridge “supercluster” had “no basis in economic reality”. He also claimed plans to “join up the region” through expanded railways would result in lost land and earnings from farming families.

“Oxford and Cambridge are world-class universities but are only linked by the most profitable UK area for housebuilding, which is the driving force behind the arc concept, not high-tech, entrepreneurship or academia.”

Objections aside, there remains interest in developing the arc. Including from the Oxford-Cambridge Supercluster Board, which told the government a developed arc could benefit the economy by £50bn per year by 2030.

Spinout success

Oxford and Cambridge are fertile breeding grounds for university spinouts, producing more than 359 companies from 2011 to January this year – taking first and second place across the UK, according to Beauhurst.

These spinouts have contributed significantly to the UK’s economy, climate change efforts, and pushed boundaries in fields ranging from biotechnology and quantum computing to AI and clean energy.

Who comes out on top? It depends on the metric. For spinout creation, the University of Oxford remains the leading institution, producing 210 between 2011 and January 2024, versus 149 for the University of Cambridge.

But while spinouts from the University of Oxford receive pre-money valuations that are on average £4m higher than their University of Cambridge counterparts, they are 2.5 times more likely to go bust, according to data compiled by accounting firm Price Bailey.

But Dominic Vergine, CEO and Founder, Monumo, believes “One thing that I believe is critical to much of the innovation in Cambridge is the university’s spinout structure. The university has always taken a more founder-friendly approach to the university’s equity stake in a spinout, making it easier to create a commercial business that can grow. If this was to ever change, I’m sure we would see a dip in the number of successful Cambridge startups.”

Combined, Oxford and Cambridge spinouts have raised more than £7bn since 2011. This includes Biomodal, an engineering biology company focused on developing genome sequencing technologies. It has raised a total of £106m in equity since it launched in 2014.

Other notable spinouts include Vaccitech, the Oxford-based startup behind the technology used in the AstraZeneca Covid-19 vaccine, and Cambridge Quantum Computing, now Quantinuum, which has become a global leader in quantum software and quantum cybersecurity.

Oxford and Cambridge spinouts have gone on to generate significant returns for investors, tech transfer offices and founders. University of Oxford spinout Onfido, which has created software to verify customer identities, was acquired by US payments firm Entrust in 2024. It was the university’s largest-ever return on investment for a student-led startup. Meanwhile, Oxford Nanopore Technologies, 2021 IPO raised gross proceeds of £428m.

The thriving spinout ecosystem in the two cities is largely down to strong tech transfer offices, such as Oxford University Innovation and Cambridge Enterprise, world-renowned academic departments and a pipeline of ideas in sectors such as life sciences, quantum technologies, and advanced materials.

Despite these successes, there has been a wider debate about the size of the equity stakes that some universities in the UK take in startups formed within their walls. A £42m raise for Oxford-founded quantum startup Quantum Motion in February 2023 was celebrated by those in the tech world but some raised questions about how little equity the founders reportedly owned between them – less than 5%. Quantum Motion CEO James Palles-Dimmock responded by saying that there was a “large ESOP” (employee stock ownership plan) so the company could “keep founders motivated”.

In March 2023, the UK government launched a review of spinout, with its scope including an assessment of the equity stakes taken by universities in startups. The review advised that universities take no more than a 10% stake in less IP-intensive spinouts. The upper limit, which applies to more IP-intensive firms such as biotech and life sciences, is between 10% and 25%.

Beauhurst’s data suggests that Oxford used to initially take 24.3% equity on average, while Cambridge took 12.6%. Today the university takes a flat rate of 20%, with 80% for the founders, according to Oxford University Innovation’s CEO Matt Perkins. Meanwhile, equity stakes for University of Cambridge spinouts are negotiated on a case-by-case basis, based on factors including IP and the number of founders.

While Sarah Haywood, managing director at Advanced Oxford, has praised the spinout success coming out of the regions, she said: “There is a very active angel network (OION/Oxford Innovation Finance) and good active investors, including Oxford Science Enterprises but there is a need to broaden and deepen pools of capital.

“More angel investors, and a more diverse pool of angels, are needed. It is still challenging for companies to secure seed/early stage investment, particularly if they are outside University of Oxford support systems (i.e. not a spinout).”

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.