Betting exchange Smarkets has rebranded and is switching its focus to professional sports traders

Founded three years ago, Smarkets uses proprietary financial trading technology to offer an online betting exchange to professional sports punters, traders and arbitrage bettors. The company also claims to offer the lowest commission in the industry, of 2 per cent.

Smarkets took a $2.3m investment from T-Venture, Deutsche Telekom’s venture capital arm, last February, and the company says it is now working to “shake up” the betting and gaming industry.

“Our current customers are sophisticated, tech-savvy traders, arbers and hedge funds,” says Jason Trost, CEO and co-founder of Smarkets. “They are looking for a sleek, reliable trading experience that offers high liquidity, security and best pricing.

“This new brand and features are the next step in our evolution, but we’re not looking to stop here. We’re working on further features such as analytics and different order types, and I want to keep lowering transaction costs well below our current commission of 2 per cent.”

New features

Trost adds that Smarkets’ new features including a “best price execution feature”, meaning that if a more favourable price becomes available in between a user placing a bet and the bet being taken, the user’s order will be automatically matched at the better price, marks the next step in the company’s evolution to a professional exchange platform. “The new brand reflects this positioning and there are other new features to come in the coming months ahead,” says Trost.

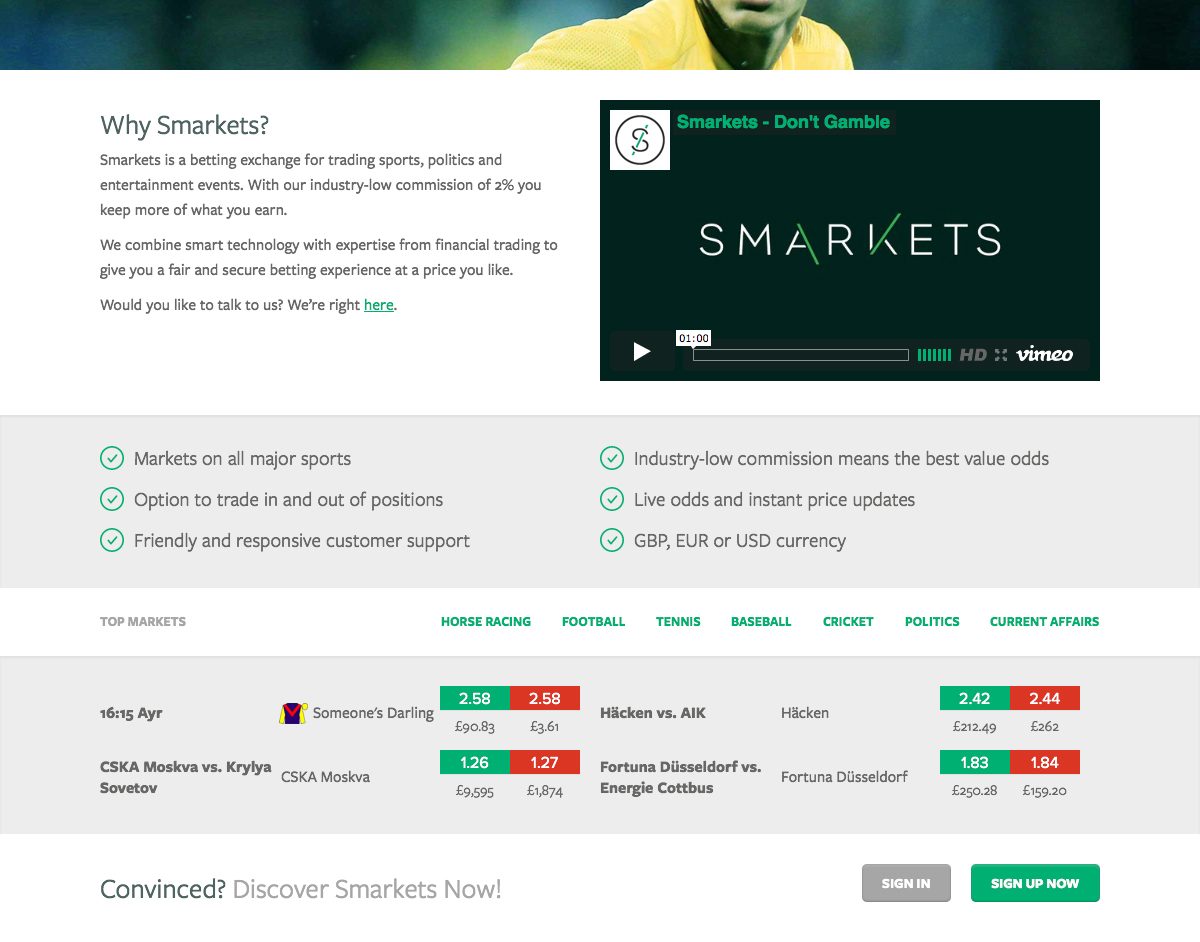

In addition to a refreshed website front-end, Smarkets will now offer users access to the golf and motorsports markets for the first time, while international customers can place bets in US dollars alongside the existing euro and pound sterling options.

The site also features a new API for market makers, meaning that existing market makers will be able to push more orders and therefore provide more liquidity. Smarkets can also accept additional new market makers onto the platform and, as a result, will have more liquidity in less active markets such as baseball, volleyball and ice hockey that were not previously seeded by market makers.

Investment

Earlier this year, in February, Smarkets raised $2.3m of VC funding with T-Venture as lead investor.

Randeep Wilkhu, senior investment manager at T-Venture, who is responsible for the investment, says that he sees “disruptive potential” in Smarkets’ financial trading technology. “Jason is the type of charismatic entrepreneur with an enticing vision we like working with, and his background in computer science coupled with financial trading expertise is a rare asset in the sports betting industry.”