Dzing, a new to market electric money and payment institution has today announced the launch of its new mobile payment app, to allow international students, remote freelancers, overseas workers, and travellers, conduct financial services from their smart devices at high speed.

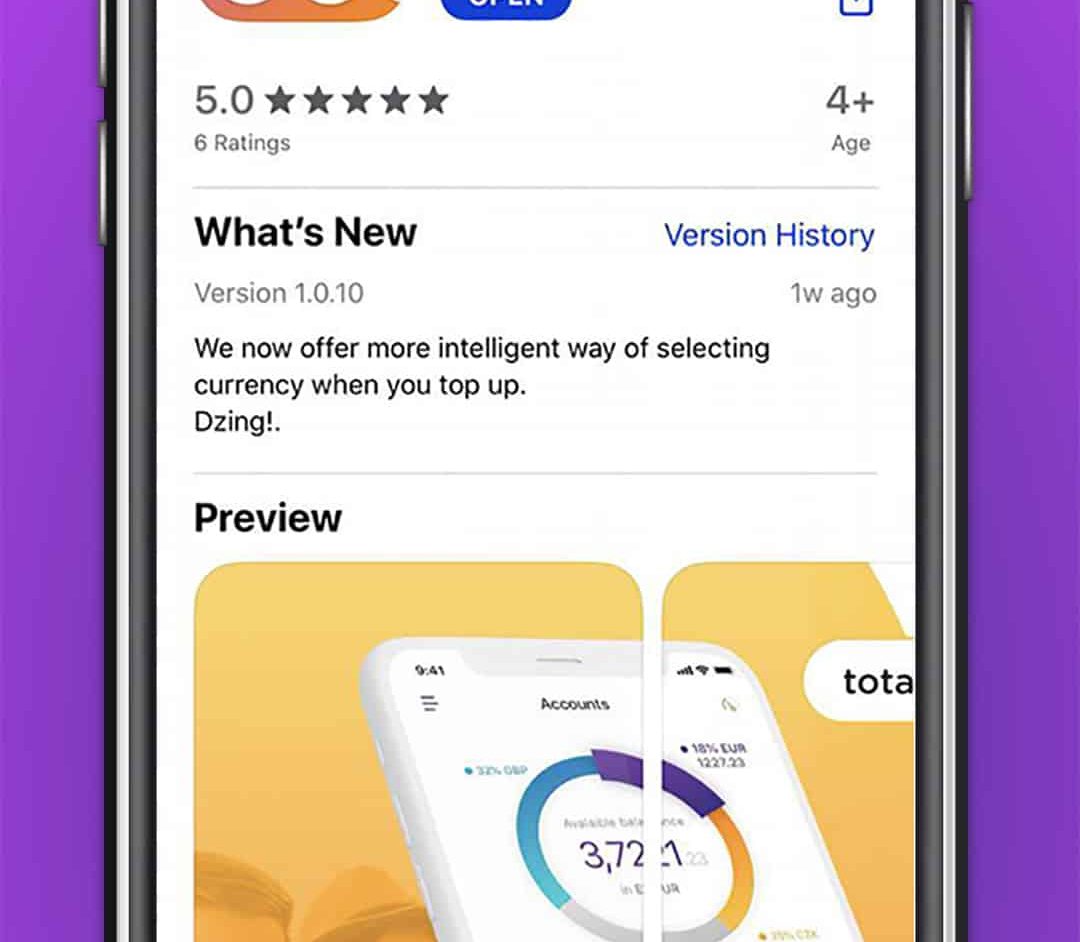

Now available on Android and iOS, the Dzing app will offer its users a simple, seamless process for transferring funds across borders in the UK and Europe.

The app will also provide its customers with multi-currency accounts, as well as card and partner card options for users.

Aiming to fill a gap in the market, Dzing will combine the customer centric nature of a traditional financial service institution with the innovation of a tech savvy fintech challenger, to meet the demands of the niche digitised customer profile.

With this unique position, Dzing will become an organic extension of users’ lives, providing a comprehensive offering covering both everyday account management and more long-term savings features.

Pioneering a ‘snack and share’ approach, users will be able to pick and choose which aspects of the product they want and need at any given moment.

Max Kharchenko, Interim CEO & Chief Product Officer, said: “We at Dzing are convinced that consumers deserve a payment service partner that evolves with them and anticipates their needs at every stage of life.

“While some consumers bank digitally, and others still favour the services of traditional banks, we spotted a gap in the market – a middle ground. So, we combined the long-term deposit uses of a traditional bank with the flexibility of a challenger bank, to support a truly modern way of living. This product is designed to put the power back into the consumers hands, providing speed and convenience, while removing the worry of currency conversion rates and hidden surcharges for anyone abroad or travelling.”

Since its inception, the Company has opened 2 new offices in preparation for the launch and is ready to make a number of new hires.

Having raised significant funding from an original seed investor at the start of its journey, the Company is getting ready to expand further with the help of additional funding before the end of 2020.

Kharchenko adds: “We have significant plans in place to introduce both business to business and consumer focused services, both built on a sustainable business model and set to change the nature of banking for the long term.”