For any Formula 1 fan, these are worrying times. In the last few weeks, two of the paddock’s smaller teams Caterham and Marussia have gone into administration, casting a huge shadow over the future of the sport.

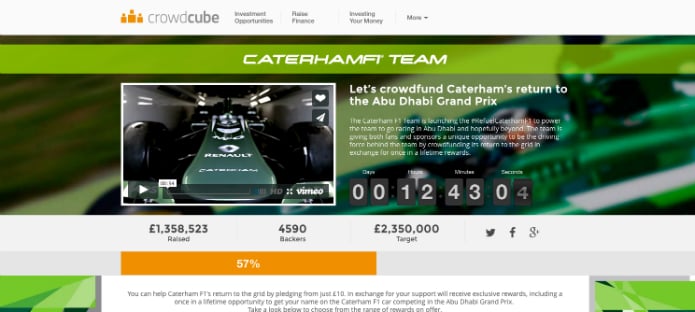

However, from the depths of despair, last week a light emerged at the end of the tunnel. One of the two ‘doomed’ teams Caterham launched a crowdfunding initiative designed to secure the £2.35m required to race in the title-deciding Abu Dhabi Grand Prix on 23rd November.

As I write, Caterham is halfway there with three days left until Friday’s deadline. I’ll be keeping my fingers crossed.

Bernie says no to crowdfunding

Not everyone is rooting for them though. Last week in an interview printed on the BBC Sport website F1 boss Bernie Ecclestone complained: “We don’t want begging bowls. If people can’t afford to be in Formula 1, they have to find something else to do.”

Unsurprisingly, Christian Horner, team principal of the handsomely-funded Red Bull, agreed; “The concept of that is wrong and shouldn’t be allowed”.

As a financier and a crowdfunding advocate, comments like those offered up by Ecclestone and Horner really rankle. To me it symbolises the all-too-common opinion that alternative finance – particularly crowdfunding – in some way isn’t a serious or respectable solution to raising finance.

This couldn’t be further from the truth.

Intelligent investment

Whether it’s a Formula 1 team like Caterham or a UK business that dreams of becoming a FTSE 100 company, whether rewards or equity based, crowdfunding can be a vehicle for intelligent investment that transforms whole industries. In the case of equity crowdfunding, it’s well-regulated, highly effective way of attracting serious, credible investors.

In fact a report from Nesta and the University of Cambridge launched last week showed that 38% of equity crowdfunding investors were professional investors or high net worth individuals with an average of £199,095 being raised per project.

Alternative finance is growing

It’s not a niche industry either. Not by a long shot. The same report showed the UK alternative finance industry doubled in size from £666m in 2013 to £1.4bn in 2014.

Reward-based crowdfunding – like the Caterham example, where individuals donate towards a specific project expecting a tangible yet non-financial reward – grew 206% between 2012 and 2014. Equity crowd-funding – purchasing a stake in an early-stage company – grew 410% over the same period.

The power of crowdfunding

While I’d love to see Caterham contest the season’s final Grand Prix and secure financial backing for next year, there’s a bigger lesson here too: don’t underestimate the power of crowdfunding.

For every Ecclestone and Horner there is a cabal of smart investors who understand just how transformative crowdfunding will be for the future of raising capital. This is an industry that is here to stay.

Oh, and one more thing Bernie. If anyone wants to create a new Formula 1 team using equity crowdfunding, I’ll raise capital for them free of charge. That’s a genuine promise.

Callum Campbell is the founder and CEO of Fireflock.com. Fireflock is an equity based crowd funding platform which allows investors to participate in early stage equity, and provides high growth companies with access to a wide network of potential investors.