Defining moment in employment law

Defining moment in employment law

Today brings one of the most significant changes to employment law affecting startups, Marian Derham explains how the changes will affect your business.

From this month employees can swap workplace rights for shares, giving them a tax-free stake in their companies, but also making it easier for bosses to get rid of them. Win win? I wonder.

Offering flexibility to fast-growing firms

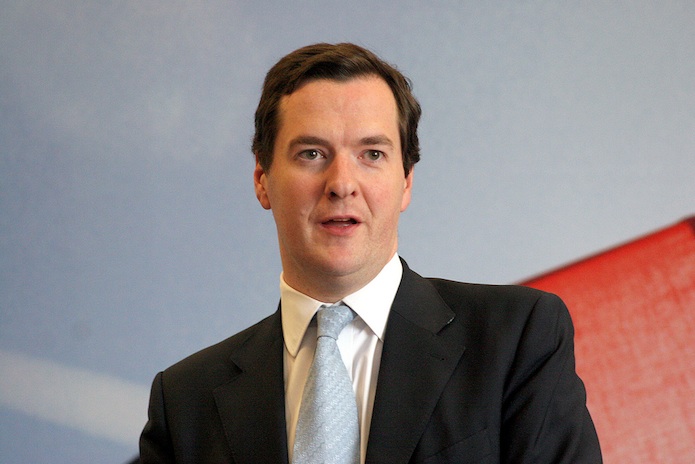

On the face of it this Government initiative, controversial when announced less than a year ago by George Osborne, is good for tech companies needing a flexible yet committed workforce.

Currently they often have neither when things get tight or people don’t work out. Best of all, they can use employee shareholder status to attract or retain the best people by offering them a stake.

How it works

This is the deal: The boss offers shares worth at least £2,000, with anything up to £50,000 on acquisition being capital gains tax free at any eventual sale.

In return, employees give up their rights to make an unfair dismissal claim and for statutory redundancy. They can also wave goodbye to the right to request time off to study or for flexible hours. They do not give up their right not to be unlawfully discriminated against.

Only new employees can be obliged to sign up, and there is no obligation to give the deal to existing ones.

The idea was designed partly with tech firms in mind, so certainly offers potentially high rewards to employees in firms with good growth expectations, and a freedom from costly unfair dismissal claims for their employers. The employees may also feel most relaxed about giving up rights they have no expectation of needing.

The drawbacks

But fools rush in without careful thought where Government asks people to tread. There are issues for both sides in my view. For employers there is the cost of having shares created and valued to standards that can pass muster with Her Majesty’s Revenue and Customs. The employer also has to pay the ‘reasonable’ costs of the employee to get advice on the proposal being offered.

There are other concerns. For example, there is nothing in the legislation about the price at which the company may buy back the shares held by their employee shareholders when they leave. This may affect the value of the shares when issued and creates uncertainty. And, of course, the company would also need to be sure it had the money available to make the purchase.

But the idea, unique to the UK, seems likely to suit expanding, confident companies best, particularly those with share options schemes already in place.

My advice

For startup entrepreneur or the small, slow growing company this just does not feel right, particularly as employees taken on since April last year need to have two years’ service before getting most unfair dismissal protection anyway.

There is also the considerable cost of setting up and administering a scheme.

Any firm that gets the paperwork wrong may find it has given away shares without the employee giving away rights.

So, what would I advise a friend running a small company ?

Probably not to bother with ‘employee shareholders’. The cost of creating them could be high and the subsequent red tape an unwelcome distraction. Low paid employees are also likely to be underwhelmed and prefer to keep their statutory rights. But others will find rights today for jam tomorrow an attractive swap.

Marian Derham is a partner at London law firm Harbottle & Lewis

image credit: flickr/altogetherfool