London-headquartered Kroo Bank is looking to raise up to £70m in a Series C funding round to grow its customer base and build its quality loan book.

The challenger bank said it aims to achieve profitability with the closure of its latest raise, which is targeting £55m to £70m from venture capitalists, family offices and private equity.

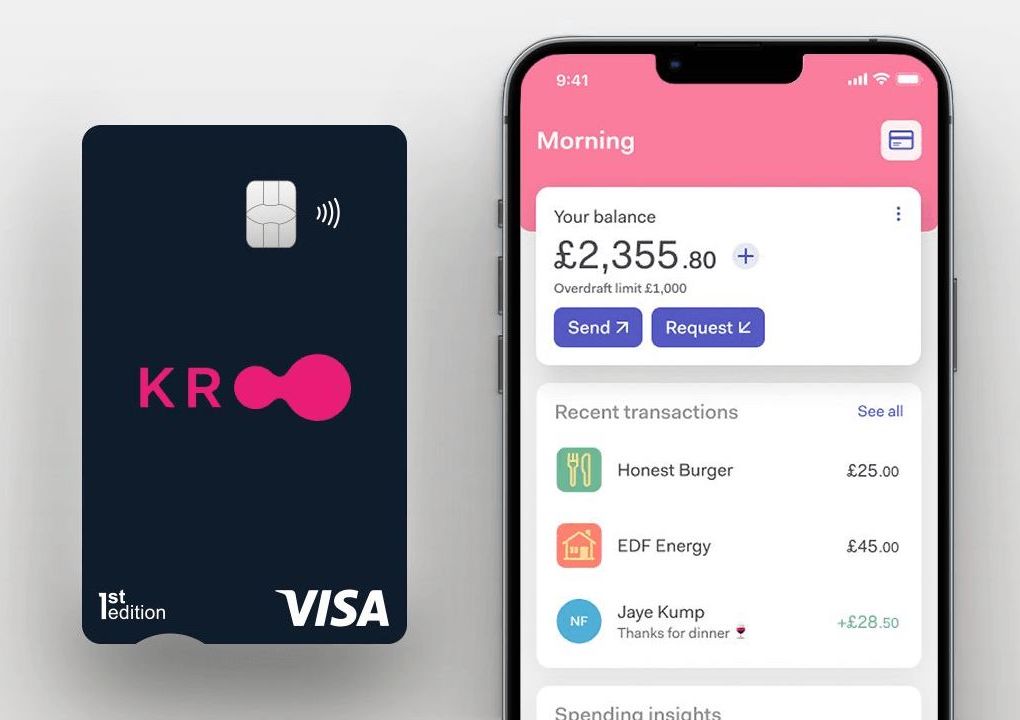

The digital lender was founded in 2016, secured its full UK banking licence in June last year and launched its first current accounts six months later. It also provides personal loans and overdrafts.

“Our growth in the last nine months shows there is an appetite for better banking, and this latest investment round will enable us to support more customers and increase the products and services we offer,” said Andrea De Gottardo, chief executive of Kroo Bank.

Since its launch, the fintech says it is “approaching” £750m in deposits across 130,000 current account users. It hopes to expand its customers to one million by 2025.

The fintech company is aiming to win over customers by passing on Bank of England base rate rises to savers. Its current account interest rate stands at 4.35% AER. Earlier this year, it was overwhelmed with new applications following a recommendation by journalist Martin Lewis over its competitive interest rates.

De Gottardo added: “We have ambitions to show it’s possible to create a successful bank that rewards loyalty and shares its success with customers. Whether rates go up or down, we’re committed to only earning 0.9% on the base rate.”

Kroo Bank has a headcount of 250 spread across its London and Manchester sites.