Merge, a banking and payments company founded by a former PayPal and Barclays executive, has raised $9.5m (£7.5m) for a platform that lets web3 companies convert funds between fiat and cryptocurrency.

The London-based startup is looking to win over web3 clients that are often perceived as too risky by traditional banks.

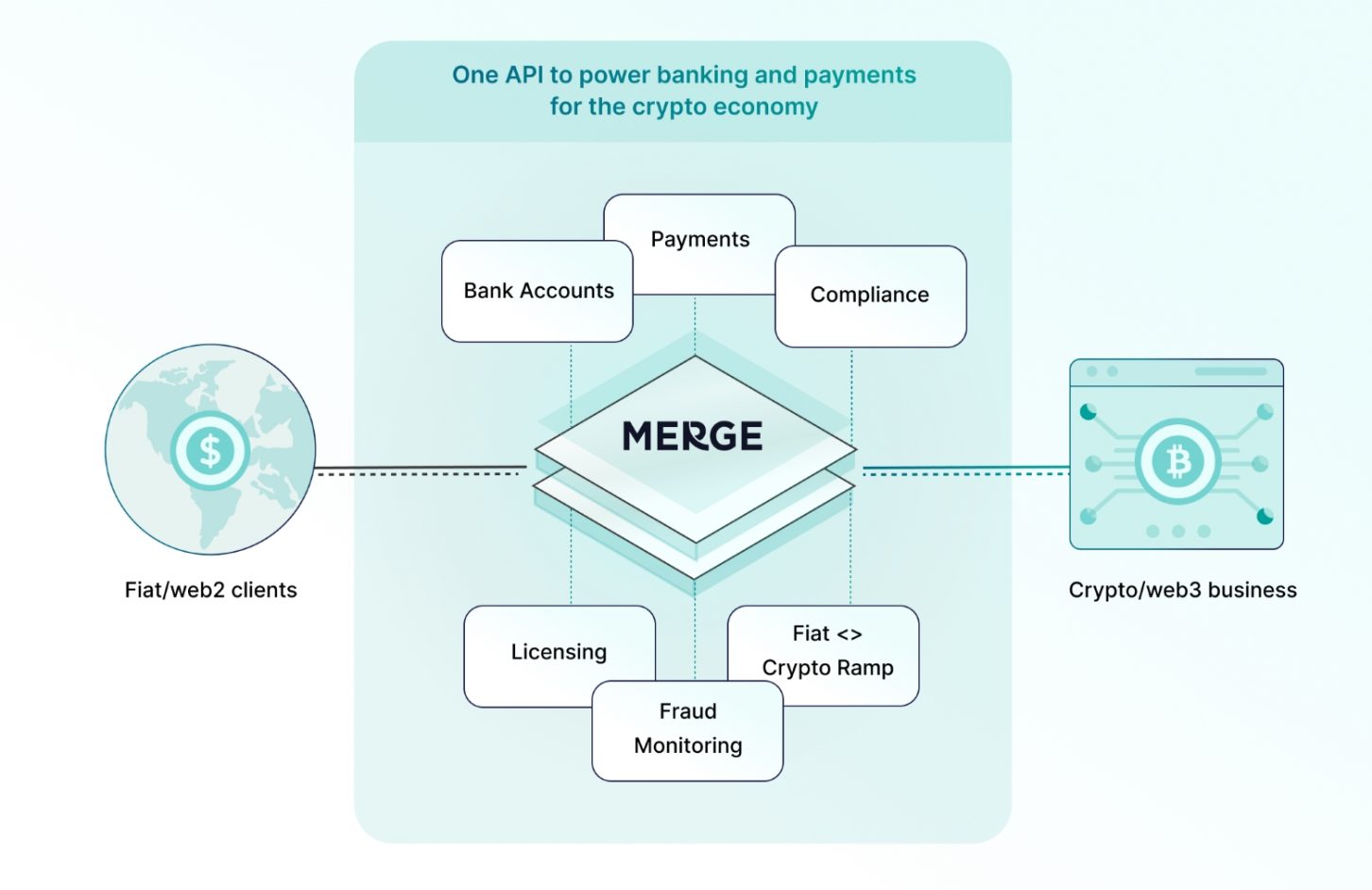

Merge said it will use the capital injection to continue developing its platform, which uses an API to “bridge the gap” between fiat and cryptocurrency ecosystems and provides services such as accounts and payments.

It also provides “low friction” know your customer and know your business solutions.

Venture capital firm Octopus Venture led Merge’s seed funding round. It also attracted capital from angel investors including the founder of Aave, co-founder of Polygon, CEO of Ledger and Barclays’ former CEO of Consumer Banking.

“As the crypto economy moves further into the mainstream, it’s increasingly clear that the current financial infrastructure isn’t fit to serve the rapid expansion of crypto-native businesses and many providers aren’t specialised enough to gauge risk,” said Zihao Xu, investor, Octopus Ventures.

Merge was founded by former PayPal and Barclays executive Kebbie Sebastian.

Merge’s raise comes amid a turbulent period for the cryptocurrency industry. The prices of major cryptocurrencies such as Bitcoin and Ethereum, along with alternative coins, have fallen dramatically over the last month.

The industry is likely to face a regulatory clampdown in the UK and elsewhere, with the Financial Conduct Authority (FCA) chair recently warning against “speculative crypto tokens” with “no underlying value”.

“Merge’s vision is to build the infrastructure necessary to allow crypto businesses to operate without fear of shutdown by regulators or third-party risk teams. We’re excited to back them as they build that and, ultimately, unleash even more innovation in crypto and defi,” added Xu.

“Exponential growth of crypto startups evidently led to dramatic increase in CeFi and DeFi assets under management, giving us strong confidence in Merge as the infrastructure provider to those institutions,” said Baek Kyoum Kim, partner, Hashed.

“Institutional players will naturally seek a reliable compliance infrastructure, and Merge is the only one-stop solution that is specifically catering to their needs.”